kaleco.online

Learn

Advantages Of Renting A House

Rental properties can be financially rewarding and have numerous tax benefits, including the ability to deduct insurance, the interest on your mortgage, and. Advantages of Renting a Home · Simpler Budgeting · Ease of Movement · Saving & Investing · Flexible Amenities · Lower Financial Anxiety. Equal Housing, Opportunity, and SBA Preferred Lender. ABA Routing Number: |NMLS# Copyright © Univest Renting vs Buying Renting vs Buying. One of the biggest advantages of owning rental properties is the consistent cash flow it can provide. By renting out your property, you have a regular stream of. There are numerous advantages to renting vs. buying a house, including: Fewer upfront costs. Typical up-front rental costs are paying the first month's rent. It is important to recognize that there are advantages and disadvantages of buying a house just as there are advantages and disadvantages of renting a house. 1. Fewer Upfront & Ongoing Costs. Buying and maintaining a home is expensive. · 2. Flexibility in the event you need to relocate or change homes · 3. More Free. The rule of thumb stated renting is cheaper than buying—so renting freed up money for other things, such as savings. The cost of renting is generally less expensive than buying the same quality of home. Rent is less expensive than a mortgage on a monthly basis in most places. Rental properties can be financially rewarding and have numerous tax benefits, including the ability to deduct insurance, the interest on your mortgage, and. Advantages of Renting a Home · Simpler Budgeting · Ease of Movement · Saving & Investing · Flexible Amenities · Lower Financial Anxiety. Equal Housing, Opportunity, and SBA Preferred Lender. ABA Routing Number: |NMLS# Copyright © Univest Renting vs Buying Renting vs Buying. One of the biggest advantages of owning rental properties is the consistent cash flow it can provide. By renting out your property, you have a regular stream of. There are numerous advantages to renting vs. buying a house, including: Fewer upfront costs. Typical up-front rental costs are paying the first month's rent. It is important to recognize that there are advantages and disadvantages of buying a house just as there are advantages and disadvantages of renting a house. 1. Fewer Upfront & Ongoing Costs. Buying and maintaining a home is expensive. · 2. Flexibility in the event you need to relocate or change homes · 3. More Free. The rule of thumb stated renting is cheaper than buying—so renting freed up money for other things, such as savings. The cost of renting is generally less expensive than buying the same quality of home. Rent is less expensive than a mortgage on a monthly basis in most places.

Both options have their own advantages and disadvantages, for example renting allows you more expendable money in the short term, while owning a house gives one. The Advantages of Owning a Home · You're paying your own mortgage instead of someone else's. · If property prices go up, you reap the rewards, not your landlord. Tax Benefits for Owning Rental Property The U.S. tax code contains laws that benefit people renting out residential properties. One of the advantages of being. The main difference between the two is the end goal — renting gives you a place to live for the length of your lease, while buying leads to homeownership. Renting is less responsibility. A life without house projects. Less costs. Renting is only rent, utilities, and insurance. It is set and. Two advantages of renting over home ownership include greater flexibility and fewer maintenance and financial responsibilities. Step by step solution. Instead, by choosing to own your home you can put that cash toward building equity month after month. 2. Control your own space. Next on the list of benefits of. Property sharing reduces the cost per person allowing you to move to an area you may have thought out of your budget. Rental properties have to conform to. Both options have their own advantages and disadvantages, for example renting allows you more expendable money in the short term, while owning a house gives one. Benefits and drawbacks of renting a home ; More flexibility. You can easily move elsewhere when the lease ends. Less responsibility. Your landlord handles. Building Equity · Stability & Sense of Belonging to a Community · Fewer Restrictions · Property Improvements · Cost Benefits: Lower Monthly Costs, Retirement Relief. 8 Reasons For Renting Out Your Home · 1. Have You Always Thought About Owning An Investment Property But Did Not Know How To Go About It? · 2. Generate Cash Flow. Leasing offers the opportunity to move without bearing the cost of selling a home and provides a more flexible way of life. discovering the benefits of renting a home. For some, renting makes financial sense; some enjoy the flexibility and mobility renting provides; while others. Renting is a great living situation for residents who want flexibility, to build their financial profile, and to not worry about tedious upkeep. Paying rent gives your money to the property owner. But, by owning a house, you may build equity. Every time you make a mortgage payment, you add to your home's. Flexibility is one of the greatest benefits of renting. Renting gives you the freedom to choose where you would want to live. If you ever feel like you've had. Renting is a great living situation for residents who want flexibility, to build their financial profile, and to not worry about tedious upkeep. Although there is one benefit to renting: your landlord is responsible for insurance on the home, maintenance and repairs, property taxes, HOA fees and other. Benefits and drawbacks of renting a home ; More flexibility. You can easily move elsewhere when the lease ends. Less responsibility. Your landlord handles.

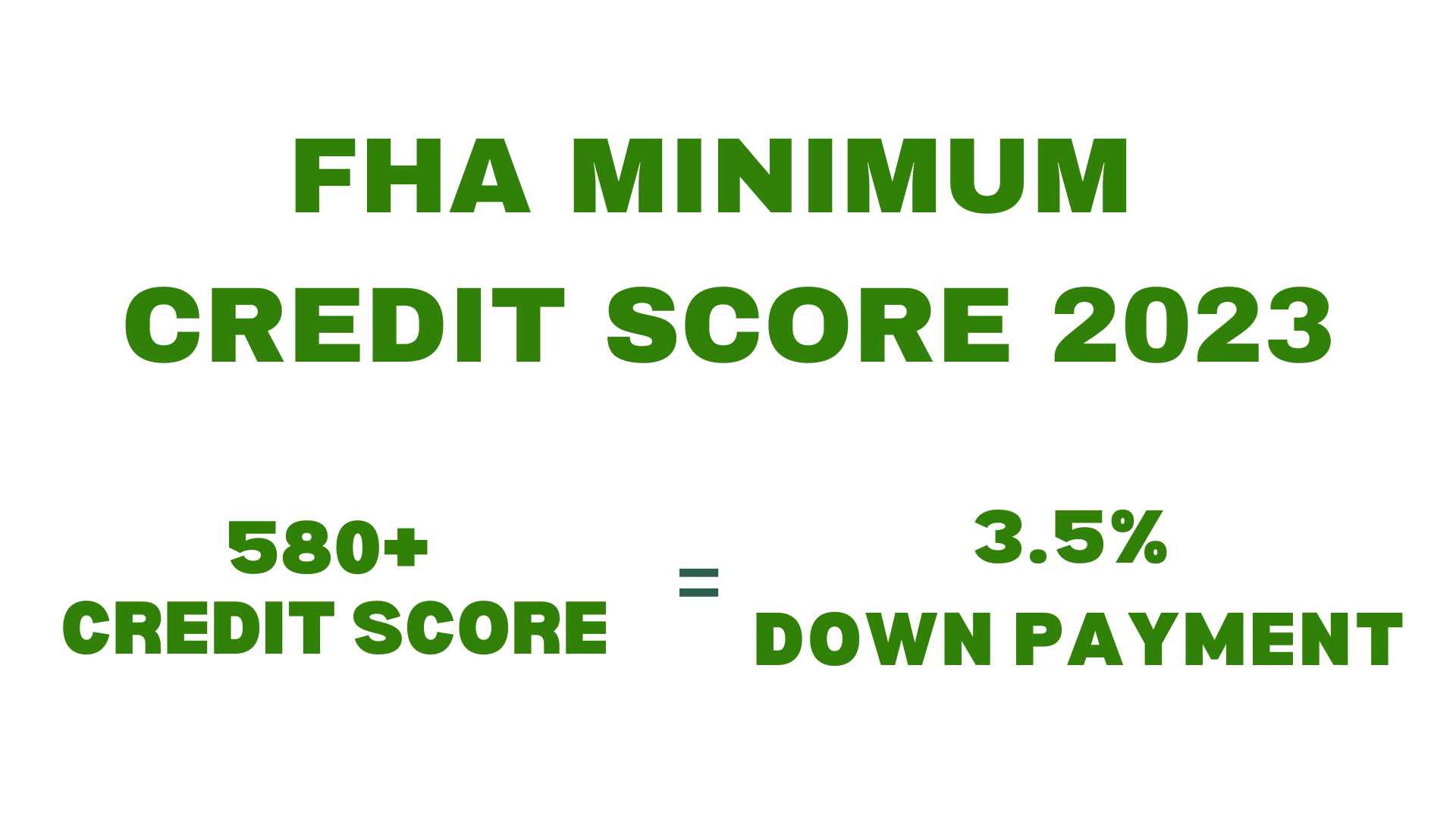

Fha Minimum Credit Score

FHA minimum is actually just , but you're unlikely to find any lender that will accept that minimum nowadays. possible, being the. To qualify for a Year FHA Loan, you'll need to make a down payment of at least percent of the total loan amount. Additionally, you'll need a credit score. To qualify for an FHA loan, you need a minimum credit score of , which is much lower than for conventional home loans, but it comes with a higher down. A minimum FICO score of to with a 10% down payment or + score with a % down payment. Steady employment history, or you have worked for the same. How Do I Qualify For An FHA Loan? · Minimum % down payment. · General minimum FICO® Score of · Debt-to-income ratio (DTI) to qualify varies, but can be as. A down payment on an FHA loan can be as low as % with a qualifying credit score of or higher. Otherwise, a 10% down payment is required which is still. Learn about Better Mortgage's minimum credit score requirements for FHA loans. What Are FHA Loan Requirements? · Credit Scores and Down Payments · History of Honoring Debts · Proof of Steady Employment · Sufficient Income · FHA Mortgage. While a minimum credit score of is typically needed, other borrowers may still qualify for an FHA Home Loan, but with certain exceptions such as a higher. FHA minimum is actually just , but you're unlikely to find any lender that will accept that minimum nowadays. possible, being the. To qualify for a Year FHA Loan, you'll need to make a down payment of at least percent of the total loan amount. Additionally, you'll need a credit score. To qualify for an FHA loan, you need a minimum credit score of , which is much lower than for conventional home loans, but it comes with a higher down. A minimum FICO score of to with a 10% down payment or + score with a % down payment. Steady employment history, or you have worked for the same. How Do I Qualify For An FHA Loan? · Minimum % down payment. · General minimum FICO® Score of · Debt-to-income ratio (DTI) to qualify varies, but can be as. A down payment on an FHA loan can be as low as % with a qualifying credit score of or higher. Otherwise, a 10% down payment is required which is still. Learn about Better Mortgage's minimum credit score requirements for FHA loans. What Are FHA Loan Requirements? · Credit Scores and Down Payments · History of Honoring Debts · Proof of Steady Employment · Sufficient Income · FHA Mortgage. While a minimum credit score of is typically needed, other borrowers may still qualify for an FHA Home Loan, but with certain exceptions such as a higher.

Minimum Credit Score of Qualifies for an FHA loan with a % minimum down payment. · Credit Scores falling between and Requires a minimum 10% down. I hear that FHA loans can be available to people with scores as low as , but they require a larger down payment. That's fine, it's not a problem. Low buyer credit scores. Conventional mortgages typically require no lower a credit score than to qualify for loan. FHA home loans allow a minimum credit. Low credit score requirements make FHA loans a great option for first-time homebuyers. Contact Access Capital Group Inc. for more information on FHA loans. What Is the Lowest Credit Score for FHA Loans? · We can often accept a minimum credit score as low as when you want to buy a home with an FHA loan. · We can. If you want to apply for an FHA home loan, you only need a minimum credit score of This is the most significant reason why a lot of people choose this. The lowest available down payment on an FHA loan is %, for which you do need to meet a credit score requirement. If you have FICO® credit score of or higher, then you can make an FHA Loan down payment as low as % of your loan amount. Additionally, financing your. If borrowers have a credit score between and they must make a down payment of 10%. FHA loans are popular and attractive to first-time homebuyers because. To qualify for an FHA loan with a % down payment, the FHA requires a credit score of at least A FICO® score will qualify you with a 10% down payment. FHA Loan Requirements. Here's what you'll need to get started. 1. Minimum Credit Score. Rocket Mortgage requires a minimum credit score of for FHA loans. At Freedom Mortgage, our current minimum FHA loan credit scores depend on whether you want to buy a home or refinance a home. Minimum credit score: You may qualify for an FHA loan with a score as low as if you're making the minimum % down payment, or Average Loan-to-Value Ratios on Purchase Endorsements by Credit Score FHA policy permits credit scores of and above, except for loans with equity. The official (government-imposed) minimum credit score for an FHA home loan is In order to take advantage of the % down-payment option, however, you. The minimum credit score for an FHA loan is Borrowers with scores of will need a 10% down payment. While the rulebook allows for scores below Average Loan-to-Value Ratios on Purchase Endorsements by Credit Score FHA policy permits credit scores of and above, except for loans with equity. A common requirement for an FHA loan credit score is , though some lenders will go as low as Conventional mortgages usually require a buyer to have a. Answer: Zero. FHA does not have a credit score requirement. You do not need to have ANY credit score to get an FHA loan. Learn how to get the best FHA Loan and Mortgage Rates with , , , , , , , & Credit Score and tips on how to improve your credit.

Low Limit Credit Card To Build Credit

Start building and improving your credit with a Capital One Platinum Secured credit card. Open your account with a refundable security deposit ($$2,). If approved, the security deposit will be used to establish your new credit limit. Establish. Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Cards No limit to the amount of cash back you can earn and cash rewards don. Apply for the BankAmericard® secured credit card to start building your credit and enjoy access to your FICO® Score updated monthly for free. Make purchases like with any credit card · Build your credit by making on-time payments · Earn 3% and 2% Cash Back on your choice of Spend Categories. Plus, you. But you could always request the bank to increase your credit limit. If that doesn't work you can simply keep the card for emergencies unless. PREMIER Bankcard credit cards are for building credit. Start building credit by keeping your balance low and paying all your bills on time each month. Secured credit cards are a different type of credit card designed to help you establish credit and can be used to improve your credit score. You're most likely to apply for a secured credit card for rebuilding credit, which often requires a security deposit that's put toward your credit limit. Start. Start building and improving your credit with a Capital One Platinum Secured credit card. Open your account with a refundable security deposit ($$2,). If approved, the security deposit will be used to establish your new credit limit. Establish. Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Cards No limit to the amount of cash back you can earn and cash rewards don. Apply for the BankAmericard® secured credit card to start building your credit and enjoy access to your FICO® Score updated monthly for free. Make purchases like with any credit card · Build your credit by making on-time payments · Earn 3% and 2% Cash Back on your choice of Spend Categories. Plus, you. But you could always request the bank to increase your credit limit. If that doesn't work you can simply keep the card for emergencies unless. PREMIER Bankcard credit cards are for building credit. Start building credit by keeping your balance low and paying all your bills on time each month. Secured credit cards are a different type of credit card designed to help you establish credit and can be used to improve your credit score. You're most likely to apply for a secured credit card for rebuilding credit, which often requires a security deposit that's put toward your credit limit. Start.

Ask for an increase on your credit card limit · Pay off a portion before your statement cycle ends so your statement balance is around or less than 30% of your. This means your limit won't be that high, but they are a great way to start building credit. Some of the best secured cards include the Capital One Platinum. Secured credit cards can help you build credit just as any other credit card. However, make sure you have all the terms of these cards before you sign up — some. Path to a credit limit increase. Terms apply2. Learn more. Arrow to the right. Petal 1. Build credit without an annual membership fee. Petal 1 Card. dollar. There are many starter credit cards which allow cardmembers to build up their credit without having to put money down as collateral. If you have no credit or low credit, a secured card can provide you with a path to building or repairing your credit. As you use your card, you'll earn rewards. Secured cards often have lower credit limits than unsecured cards. Photo illustration by Fortune; Original photo by Getty Images. Most major credit card issuers. One of the best low limit credit cards is Credit One Bank® Platinum Visa® for Rebuilding Credit. This card has a minimum credit limit of $ With the Credit. Authorized users can build their credit history if the primary cardmember uses their card responsibly, like paying their bill on time and keeping a low credit. You may want to find a secured credit card that charges low annual fees or waives them altogether. Secured credit cards may also have a low credit limit to. Say that all the credit cards you currently have are all above a $3k CL. Then you decide to apply for the CFF or CSP or the new WF Attune or any card that you. Low credit limits. Because your credit limit is typically based on your security deposit, it can be quite low, which is a drawback if you are looking to make. You can get a credit card with bad credit, but it won't be one of those cards you see advertised with rich rewards or exclusive perks. It will probably be. If you are one hundred percent committed to making on-time payments to all of your creditors and keeping your balances low compared to your credit limits, you. This card also comes with regular credit limit reviews, which could help you build credit by decreasing your utilization if you qualify for a higher credit line. After you have low utilization after a couple months, apply to other cards that'll give you a higher limit. I used to only have a secured visa. Traditional credit scores can only generate a number based on what is in your credit file and what is in your credit file comes from companies that report. Spend within your limit and pay your bill when it's due. Over time, this will help build your credit and you may be able to graduate to a traditional card. A secured credit card is an effective way to build credit if you are unable to qualify for a regular credit card or a student card. In general, consumers looking for subprime credit cards should be able to establish much higher credit limits via secured credit cards rather than the unsecured.

Best Hair Styling Gel Men

The gel for men from our by JM Keune line provides extra strength and great shine. The men's gel nourishes and strengthens the hair, preventing hair. This styling gel is fit for a royal, lasts all day, and never flakes. It was created to perform just like our original formula of MODE Styling Gel. American Crew Pomade is nice. Has a good smell and doesn't leave your hair glossy. Definitely gives some volume. We recommend the Scalp Rescue Sculpting Gel for more extreme hold. Still undecided? Check the recent Curl Magazine independent reviews of this hair gel. You can. Forte Series offers exactly what men need to start a first-class grooming routine. Our products are formulated with barber-grade ingredients that style. We've compiled a guide to Kiehl's best hair products for men to help simplify your haircare routine. Ahead, discover our best styling products for men, as well. LSB Head Educator Pavlos talks you through the best hair products for men, helping you to create the perfect hairstyle every time! Find out more here. • Hair, • MEN'S GROOMING, Hair Spray, Styling Gel / Wax / Pomade · L3VEL3 Texturizing Sea Salt Spray. No reviews. $ Pomade has become the more preferred hair product for men these days, compared to gels and waxes. Applying pomade to your finished style will give it a really. The gel for men from our by JM Keune line provides extra strength and great shine. The men's gel nourishes and strengthens the hair, preventing hair. This styling gel is fit for a royal, lasts all day, and never flakes. It was created to perform just like our original formula of MODE Styling Gel. American Crew Pomade is nice. Has a good smell and doesn't leave your hair glossy. Definitely gives some volume. We recommend the Scalp Rescue Sculpting Gel for more extreme hold. Still undecided? Check the recent Curl Magazine independent reviews of this hair gel. You can. Forte Series offers exactly what men need to start a first-class grooming routine. Our products are formulated with barber-grade ingredients that style. We've compiled a guide to Kiehl's best hair products for men to help simplify your haircare routine. Ahead, discover our best styling products for men, as well. LSB Head Educator Pavlos talks you through the best hair products for men, helping you to create the perfect hairstyle every time! Find out more here. • Hair, • MEN'S GROOMING, Hair Spray, Styling Gel / Wax / Pomade · L3VEL3 Texturizing Sea Salt Spray. No reviews. $ Pomade has become the more preferred hair product for men these days, compared to gels and waxes. Applying pomade to your finished style will give it a really.

Got2b Glued Styling Spiking Glue, 6 OZ. Got2B. 80 ; TRESemme Extra Hold Hair Gel. TRESemme. ; Garnier Fructis Pure Clean Styling Gel, OZ. Garnier. SKU: Categories: For Men, Styling Products Tags: for 3 reviews for Silver Fox Style & Shine Hair Gel 10 oz. Rated 5 out of 5. Steph. You can use it daily for a long lasting medium hold and semi-glossy shine. It's great for controlling frizz or flyaways. Our Styling Hair Gel keeps your look in. Oribe Dry Texturizing Spray With more than 5, 5-star ratings on Amazon, Oribe's Dry Texturizing Spray is a certified bestseller for styling straight hair. results ; Harry's Sculpting Gel - Firm Hold Men's Hair Gel - fl oz · Harry's ; American Crew Fiber - 3oz · American Crew ; Wet Line Xtreme Pro Styling Gel. Hair pastes, wax pomades, hair creams, hair gels and other men's hair styling products help men achieve the perfect style. Overall, Vanicream Hair Gel is a great hair styling product without harmful additives. Specifically, it's free from dyes, fragrances, parabens, botanical. Men's Hair Gel(19) · TRESemme Hair Styling Gel Extra Firm Control Extra Hold · Dandymen Collection No-Fuss Men's Vanilla Tobacco Sea Salt Spray, oz · Garnier. Add body and shine to hair with Tea Tree Styling Gel, a refreshing hair gel with tea tree oil that invigorates the senses It smells great and gives his hair a. Premium products originally developed for Hollywood stars by expert hair stylist Juan Juan. Men's strong hold gel. My husband loves this in his retired. Our men's hair styling gel packs tough holding power and has Ginseng and Eucalyptus for a great look and feel. Part of our men's line: The Art of Giovanni. Sculpting Gel Texture; Hair Styling Group Photo. Sculpting Gel oz. | $9. Hair gel for men—for style that stands its ground. What's good about it. Firm hold. Browse our collection of products formulated for a robust hold. Including: clay, paste, pomade, gel and spray. gelactica hair styling gel for men. Open media 5 in modal. best hair gel for men. Open media 6 in. This medium hold hair gel for men is perfect for men with curly hair or want hairstyle with movement. Grip Tight Hair Gel for men adds shine. The gel for men from our by JM Keune line provides extra strength and great shine. The men's gel nourishes and strengthens the hair, preventing hair. Discover our Men's Hair Styling Gel, formulated for all hair types to provide versatile styling with exceptional hold and shine. Infused with Aloe Vera and. Sephora customers often prefer the following products when searching for best styling gel. · Bumble and bumbleCurl Anti-Humidity Hair Gel Oil · PATTERN by Tracee. Our natural hair styling gel is specifically designed for men with thin hair If you're not convinced that this is the best styling gel on the planet. Mens Hair Gel ; eco styler Hair Styling Gel (16 Ounces). eco styler ; Got2b Spiked Up Styling Hair Gel, Max Control ( oz) · Got2b ; Harry's Hair Sculpting Gel.

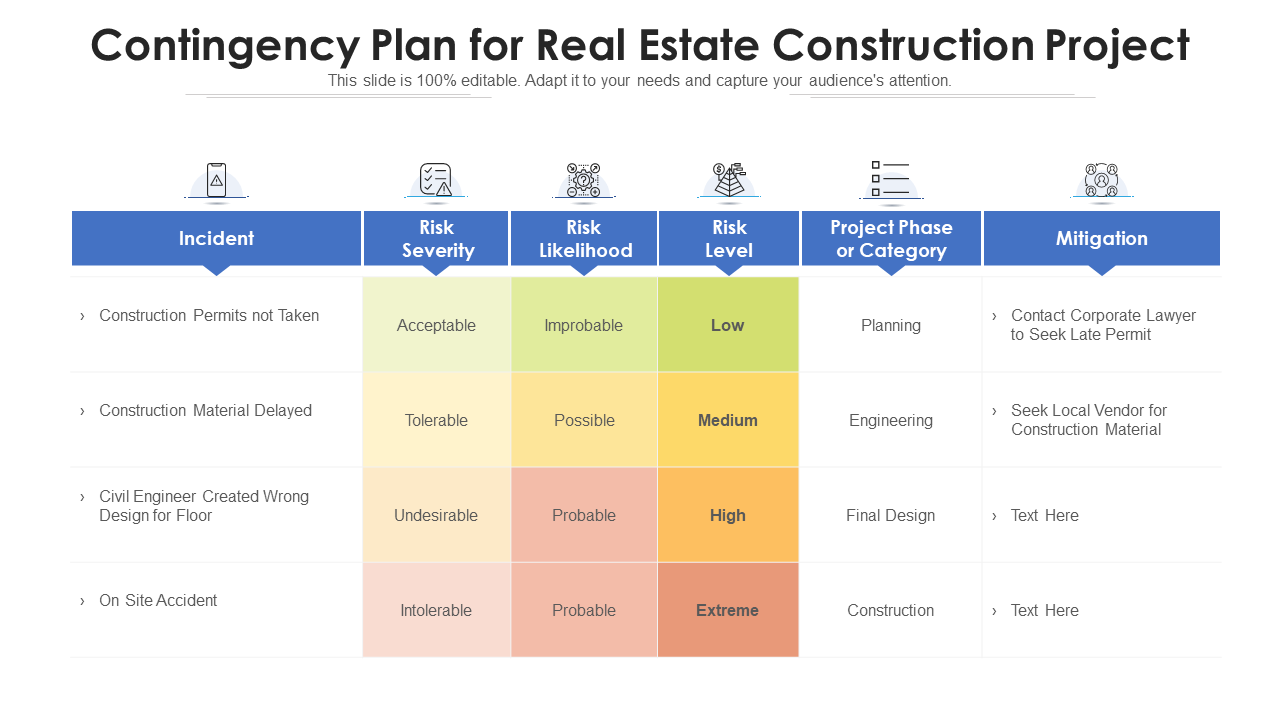

Contingency Plan For Buying A House

How it works: Your Offer to Purchase is contingent on your lender's written commitment to give you a mortgage by a specific date. If your mortgage is not. Generally, these are written up that you wouldn't own the home. You put in an offer to buy the house, they accept the offer, but it only "starts. In the context of buying a home, contingencies are clauses in the purchase agreement that allow you to back out of the deal or renegotiate certain terms if. With a home sale contingency, your offer is contingent on the sale of your current home. You'll usually need to include a timeline, such as 30 to 60 days, in. Almost all home sale contracts contain a mortgage contingency. Mortgage contingencies require the buyer to secure a home loan from a lender or other source of. A loan contingency is a clause in a real estate contract that the buyer must meet before the sale of a home is approved. Keep in mind we're not lawyers so this. The home sale contingency clause can be complicated to both structure and present to your buyer or seller. As the real estate professional it is critical to. Basically, real estate contingencies provide the buyer and seller a way to take a step back in a transaction if the agreed upon conditions are not fulfilled. When dealing with appraisals, loans and flaws in the condition of the house you're about to buy, having a contingency plan allows you to back out of the. How it works: Your Offer to Purchase is contingent on your lender's written commitment to give you a mortgage by a specific date. If your mortgage is not. Generally, these are written up that you wouldn't own the home. You put in an offer to buy the house, they accept the offer, but it only "starts. In the context of buying a home, contingencies are clauses in the purchase agreement that allow you to back out of the deal or renegotiate certain terms if. With a home sale contingency, your offer is contingent on the sale of your current home. You'll usually need to include a timeline, such as 30 to 60 days, in. Almost all home sale contracts contain a mortgage contingency. Mortgage contingencies require the buyer to secure a home loan from a lender or other source of. A loan contingency is a clause in a real estate contract that the buyer must meet before the sale of a home is approved. Keep in mind we're not lawyers so this. The home sale contingency clause can be complicated to both structure and present to your buyer or seller. As the real estate professional it is critical to. Basically, real estate contingencies provide the buyer and seller a way to take a step back in a transaction if the agreed upon conditions are not fulfilled. When dealing with appraisals, loans and flaws in the condition of the house you're about to buy, having a contingency plan allows you to back out of the.

A home sale contingency is a clause you can add to an offer to protect you in case your current home doesn't sell. Some of the more common examples of real estate contingencies are insurance, appraisal, home sale and title. 2. What is contingency removal? Contingency removal. The contingency clause gives a party to a contract the right to renegotiate or cancel the deal if specific circumstances turn out to be unsatisfactory. An. A contingent offer on a house is an offer with a protective clause on behalf of the buyer. The contingency communicates that if the clause isn't met, the buyer. Almost all home sale contracts contain a mortgage contingency. Mortgage contingencies require the buyer to secure a home loan from a lender or other source of. In the context of buying a home, contingencies are clauses in the purchase agreement that allow you to back out of the deal or renegotiate certain terms if. Contingencies in a real estate contract also represent steps along the way that allow the buyer to back out of the deal without losing her earnest money deposit. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. The most common home buying contingency is the home inspection contingency. Whether a buyer is paying cash or obtaining financing odds are they'll want to have. For buyers, contingencies can help to ensure that they are not purchasing a home that is not worth the price or that has major defects. For sellers. The home sale contingency is straightforward at the onset, outlining that the buyer is making the offer contingent on their current house being. Any property that has multiple buyers willing to buy it it's almost a must to waive contingencies if you want a real shot of having your offer accepted. Meanwhile, buyers often make their purchases dependent on positive inspection reports or put a financing contingency clause in the contract if they are, in fact. These contingencies are designed to ensure that the property in question meets certain standards and that the financing necessary for the purchase is attainable. Owners whose home is in contingent status can accept a backup offer, and that offer will have precedence if the initial deal does not go through. The fee is designed to protect the buyer in the event that something goes wrong with the transaction. For example, let's say that you are buying a house and you. If the seller has their own contingency because they are also buying a home, it will make your offer unusable. If you can arrange your finances. Basically, real estate contingencies provide the buyer and seller a way to take a step back in a transaction if the agreed upon conditions are not fulfilled. A contingency is a clause in a purchase contract that most commonly protects the buyer. The term means an event that may but is not certain to. The fee is designed to protect the buyer in the event that something goes wrong with the transaction. For example, let's say that you are buying a house and you.

How To Make Remote Employees Feel Included

Ways to keep remote employees engaged · 1. Encourage health and wellness. · 2. Host virtual meetings and casual hangouts. · 3. Make sure employees feel heard and. 3. Make it a team effort with collaborative tools · Zoom / Skype - include remote team members in weekly meetings · Slack / WhatsApp - to encourage chats. Schedule regular video calls. · Host virtual team-building activities. · Promote informal conversations. · Host remote social events. · Foster mentorship. 1. Create a Company Culture of Connectedness. Employees often feel as though they belong to the group of people they work with. Managers should set the tone of. Making sure to check in with how your remote employees are doing will make them feel a stronger sense of belonging. Instead of jumping straight to business. Keeping remote employees happy isn't overly complicated: ask them what they may need, and make sure they feel included. Sometimes it's as simple as some. One-On-One Video Calls With the Founder(s). To make the employees feel like their voices are heard, leaders need to have one-on-one meetings with them – whether. Live your company values and make them 'experience-able' for everyone. Stream or at least record any business meeting relevant to the team, no matter where they. The 5 Best Ways to Make Remote Employees Feel Like They're Part of the Team · 1. Establish Bonds of Friendship and Empathy · 2. Pair Up Remote Workers · 3. Provide. Ways to keep remote employees engaged · 1. Encourage health and wellness. · 2. Host virtual meetings and casual hangouts. · 3. Make sure employees feel heard and. 3. Make it a team effort with collaborative tools · Zoom / Skype - include remote team members in weekly meetings · Slack / WhatsApp - to encourage chats. Schedule regular video calls. · Host virtual team-building activities. · Promote informal conversations. · Host remote social events. · Foster mentorship. 1. Create a Company Culture of Connectedness. Employees often feel as though they belong to the group of people they work with. Managers should set the tone of. Making sure to check in with how your remote employees are doing will make them feel a stronger sense of belonging. Instead of jumping straight to business. Keeping remote employees happy isn't overly complicated: ask them what they may need, and make sure they feel included. Sometimes it's as simple as some. One-On-One Video Calls With the Founder(s). To make the employees feel like their voices are heard, leaders need to have one-on-one meetings with them – whether. Live your company values and make them 'experience-able' for everyone. Stream or at least record any business meeting relevant to the team, no matter where they. The 5 Best Ways to Make Remote Employees Feel Like They're Part of the Team · 1. Establish Bonds of Friendship and Empathy · 2. Pair Up Remote Workers · 3. Provide.

Create opportunities for social interaction. Organize virtual events such as happy hours, coffee chats, trivia games, etc. where remote workers. Make all org-wide updates digital. Nearly 20% of remote workers feel disconnected from peers due to a lack of communication. While communication is the. Getting everyone on camera via video chat allows employees to make eye contact, pick up on facial or emotional cues, and generally connect as if they were. Foster a culture in which your employees are encouraged to reach out to each other and socialize online on their own terms. “Really knowing your team will make. Make sure everyone is included in the conversation. Ensuring that everyone is included in the conversation is an important part of remote employee engagement. Consistent, open communication is a common difficulty with remote teams, so you must put in a little extra work to make people feel connected when your. Effective communication is the core of any successful remote work setup. Ensure that remote employees have access to reliable communication tools and platforms. 7 Things You Can Do Today To Give Your Remote Teams Social Support · 1. Encourage acts of kindness · 2. Unleash your Employee Resource Groups · 3. Celebrate. Question: What is your best tip for making employees working remotely feel integrated into the culture of your company? Remote workers often end up putting in more hours than their office counterparts, yet they sometimes feel like they aren't part of a team. So, you need to make. Another thing that is always missing from remote employees lives is "Water-cooler' chats. Don't only talk to those people about work. Try to. Examples of how to make remote employees feel connected · #1: Have a dedicated (and active) virtual water cooler chat to connect · #2: Create opportunities to. Create opportunities for social interaction. Organize virtual events such as happy hours, coffee chats, trivia games, etc. where remote workers. Bias-free culture: With remote employees, decision-making, ownership, and collaboration often feel like myths. Prioritising remote employees' interests. 1. All Hands Meetings and Communication · 2. Invite Remote Employees to Office Events · 3. Make Your Office Feel More Like Home · 4. Encourage Part-Time Remote. Here are tips on how to make remote staff feel that they are part of the team: Promote knowledge sharing across your team. 5 Practices to Help Make Your Remote Employees Feel Engaged · Recruiting the right people · Working in teams together · Solving disagreements · Building a positive. remote workers, regardless of their background, location, or personal circumstances, feel included, valued, and supported. A diverse approach fosters. Keeping remote employees happy isn't overly complicated: ask them what they may need, and make sure they feel included. Sometimes it's as simple as some. 1. Increase the frequency of all-staff meetings. Bringing everyone together on a regular basis to share business updates helps every team member to feel seen.

Capital Gains Tax Rate On Stock

Capital gains are subject to the standard CIT rate of 18%. Taxable as ordinary income. United Arab Emirates (Last reviewed 24 July ), Same as UAE CT rates. Short-term capital gains are taxed at your ordinary income tax rate. You'll pay somewhere between 10% and 37% of your short-term capital gains depending on your. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. The three levels for long-term capital gains taxes are 0, 15, and 20 percent. Some special tax treatments exist for specific stocks, collections, and real. Long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income and filing status. Yes, this means that you can pay as little as 0% in. You generally treat this amount as capital gain or loss, but you may also have ordinary income to report. You must account for and report this sale on your tax. Short-Term Capital Gains Tax Rates ; Tax Rate, 10%, 12%, 22%, 24% ; Single, Up to $11,, $11, to $47,, $47, to $,, $, to $, The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. These tax rates and brackets are the same as those applied to ordinary income, like your wages, and currently range from 10% to 37% depending on your income. Capital gains are subject to the standard CIT rate of 18%. Taxable as ordinary income. United Arab Emirates (Last reviewed 24 July ), Same as UAE CT rates. Short-term capital gains are taxed at your ordinary income tax rate. You'll pay somewhere between 10% and 37% of your short-term capital gains depending on your. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. The three levels for long-term capital gains taxes are 0, 15, and 20 percent. Some special tax treatments exist for specific stocks, collections, and real. Long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income and filing status. Yes, this means that you can pay as little as 0% in. You generally treat this amount as capital gain or loss, but you may also have ordinary income to report. You must account for and report this sale on your tax. Short-Term Capital Gains Tax Rates ; Tax Rate, 10%, 12%, 22%, 24% ; Single, Up to $11,, $11, to $47,, $47, to $,, $, to $, The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. These tax rates and brackets are the same as those applied to ordinary income, like your wages, and currently range from 10% to 37% depending on your income.

The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's. After , the capital gains tax rates on net capital gain (and qualified dividends) are 0%, 15%, and 20%, depending on the taxpayer's filing status and. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. Definitions and Rates. Long-term capital gains are taxed at three different rates: 0%, 15%, or 20%. The amount you'll pay depends on your taxable income and tax filing status As. For higher-income taxpayers, the capital gain rate at the federal level if 20%, plus a % net investment tax under Obamacare, plus %. Hawaii has the. The wash sale rules generally apply to options · 60% of the gain or loss is taxed at the long-term capital tax rates · 40% of the gain or loss is taxed at the. Long-term capital gains are taxed at 0%, 15%, or 20%, according to graduated income thresholds. The tax rate for most taxpayers who report long-term capital. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. For the tax year, this is 0%, 15% or 20% based on taxable income and filing status. Depending on your tax rate, you may want to consider other assets for. Investors pay capital gains taxes on the sale and qualified dividends of stocks, bonds, real estate and collectible assets. And high-income investors don't just. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. For example, the rate I assumed above, 37%, was used because some proposals would simply tax capital gains at the top ordinary income tax rate, which now is 37%. Short-term capital gains are gains you make from selling assets held for one year or less. They're taxed like regular income. That means you pay the same tax. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. Not all countries impose a capital gains. Capital gains refers to profits gained from the sale of capital assets. Almost everything someone owns and uses for personal or investment purposes is a. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each.

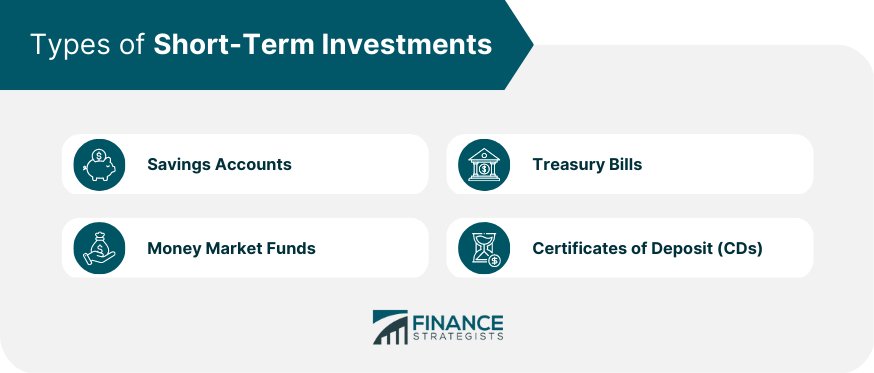

What Are Short Term Investments

Money market funds are short-term cash investments that seek to preserve your savings. Learn their benefits and how to use them. Short term notes have realized a net annualized return of % 1. Interest rates higher than most CDs, approximately 40X the national average money market. Short-term investments are assets that can be converted into cash or can be sold within a short period of time, typically within years. Common. Short-term trading in the stock market means you buy and sell stocks that are actively traded, so you can conceivably get rid of them quickly if the price. Long-term investments tend to be less risky compared to short-term ones since they have more time to overcome market fluctuations and potential downturns. A long-term investment is an asset or security expected to generate income or appreciate in value over a prolonged period, typically five years or more. Money market funds are short-term cash investments that seek to preserve your savings. Learn their benefits and how to use them. Learn about the Cash and Short Term Investments with the definition and formula explained in detail. If you are looking for liquidity plus a greater yield than that offered by a money market fund, a short term bond fund may meet your needs. Money market funds are short-term cash investments that seek to preserve your savings. Learn their benefits and how to use them. Short term notes have realized a net annualized return of % 1. Interest rates higher than most CDs, approximately 40X the national average money market. Short-term investments are assets that can be converted into cash or can be sold within a short period of time, typically within years. Common. Short-term trading in the stock market means you buy and sell stocks that are actively traded, so you can conceivably get rid of them quickly if the price. Long-term investments tend to be less risky compared to short-term ones since they have more time to overcome market fluctuations and potential downturns. A long-term investment is an asset or security expected to generate income or appreciate in value over a prolonged period, typically five years or more. Money market funds are short-term cash investments that seek to preserve your savings. Learn their benefits and how to use them. Learn about the Cash and Short Term Investments with the definition and formula explained in detail. If you are looking for liquidity plus a greater yield than that offered by a money market fund, a short term bond fund may meet your needs.

Long-term investment goals tend to be major life events further in the future, like retirement or college savings. Short-term goals are nearer future events. We have compiled some primary tips for short-term investing, to help you better prepare for your situation. Here are five reasons to pursue your financial goals through long-term investing rather than short-term trading. Short-term investments are to be reported at their fair value. The fluctuation in value is reported in the income statement. Short-term investments are investments which can easily be converted to cash, normally within 5 years of acquisition. Investment funds The Short Term Investment Pool (STIP) was established in FY76 as a cash investment pool available to all UC fund groups. STIP allows fund. 'Cash and Short Term Investments' refers to the liquid assets held by a company. These include actual cash, cash equivalents, and short-term investments. Short-term investing means placing excess cash into various assets for a short time to make quick profits. Short-term investment offers multiple alternatives to investors looking for quick turnover of profit. These can be balanced as part of your portfolio along with. Cash equivalents, excluding items classified as marketable securities, include Short-Term, highly liquid Investments that are both readily convertible to known. A short-term investment is any financial asset that matures within one year. For example, purchasing a certificate of deposit. The different types of short-term. If you are looking for liquidity plus a greater yield than that offered by a money market fund, a short term bond fund may meet your needs. For small businesses, short-term investments are typically placed in highly liquid money-market funds and/or in interest-bearing bank accounts. Longer term. Short-term investments are those that you can quickly cash in. Some of the most common examples include US Treasury bills, high-yield savings accounts. Short-term investors are investors who invest in financial instruments intended to be held in an investment portfolio for less than one fiscal year. Conversely. Cash and Short Term Investments is calculated by taking all the cash and short term investments of the company and dividing that number by the total shares. Short-Term Investments Both funds invest in short- to intermediate-term notes and bonds. Money Market requests are not appropriate for University-related. Research BMO's BMO Redeemable Short-Term Investment Certificate, its features, rates, and other details to help you decide if it's the right GIC product for. Short-term assets or securities in investments refer to assets that are held for less than one year. In accounting, the term "current" refers to a. Cash and Short Term Investments is calculated by taking all the cash and short term investments of the company and dividing that number by the total shares.

What Is A Trademark Name

A trademark is any word, name, symbol, device or combination thereof used by a person to identify goods made or sold and to distinguish them from the goods. A trademark can be a word, phrase, symbol, or design that distinguishes the source of the goods or services. Also, as trade dress, it can be the appearance. A trade mark is your registered brand and is used to distinguish your business from other products and services. A trade mark can be a letter. To get a trademark for your product name, you need to apply to the USPTO and then navigate an examination process. The purpose of a "mark" is to distinguish goods and services from those of others. Trademark, Service Mark, and Trade Name registrations are administered at. A business name generally can be protected as a trademark under federal and state trademark law. Trademark law is designed to avoid consumer confusion over. A trademark is any word, name, symbol, design, or combination of these that identifies the source of your goods or services and distinguishes them from the. Should I apply for a trademark in personal or business name? In general terms, it is advisable to tie the trademark's ownership to an entity that will be using. A trademark is any word, name, symbol, device or any combination thereof adopted and used by a person to identify goods made or sold or services rendered, and. A trademark is any word, name, symbol, device or combination thereof used by a person to identify goods made or sold and to distinguish them from the goods. A trademark can be a word, phrase, symbol, or design that distinguishes the source of the goods or services. Also, as trade dress, it can be the appearance. A trade mark is your registered brand and is used to distinguish your business from other products and services. A trade mark can be a letter. To get a trademark for your product name, you need to apply to the USPTO and then navigate an examination process. The purpose of a "mark" is to distinguish goods and services from those of others. Trademark, Service Mark, and Trade Name registrations are administered at. A business name generally can be protected as a trademark under federal and state trademark law. Trademark law is designed to avoid consumer confusion over. A trademark is any word, name, symbol, design, or combination of these that identifies the source of your goods or services and distinguishes them from the. Should I apply for a trademark in personal or business name? In general terms, it is advisable to tie the trademark's ownership to an entity that will be using. A trademark is any word, name, symbol, device or any combination thereof adopted and used by a person to identify goods made or sold or services rendered, and.

Can you trademark a person's name? · If the name identifies a living individual, consent to register must be made of record [see TMEP ]. · As with any other. Each of these terms does mean something different, and while there are gray areas, it is easiest to see trade names as relating to businesses or entities. If you began using the name before the other company registered it, you will be able to continue using it. However, you will only be able to use it in the. Your trade mark could include words, logos, shapes, colours, sounds, smells or any combination of these. Protects your logo, name and brand; Costs $ per. Name trademark. Registering a trademark in the form of a brand name provides protection solely for the name of the brand. This means that any visual elements or. Trademarks go beyond just brand names and logos. They can also include colors, sounds, and smells that represent a company's distinct identity. A trademark is a sign capable of distinguishing the goods or services of one enterprise from those of other enterprises. Trademarks are protected by. 4 Steps to Trademark a Product Name · 1) Come up with a unique brand name for your product. “My name is more important than myself.” · 2) Perform a trademark. Registration as a trademark is to brand a product or service. Registration as a business name is to identify the legal entity that owns the business (and may. “Service mark” is defined as a word, name, symbol, or device, or any combination of those terms, used by a person to identify and distinguish the services of. It offers no legal protection or limitless rights for the use of that name; it is just the name. Trade names are registered on the state level, meaning a. Names, logos, and phrases are the most popular trademarks. Trademarks represent brands. Every successful brand is built on at least one trademark. When you. A trademark is any word, name, symbol, or design, or any combination thereof, used in commerce to identify and distinguish the goods of one manufacturer or. When you register your trademark, you increase legal protections for your business name or other business marks. These protections apply regardless of whether. A trademark is a type of intellectual property consisting of a recognizable sign, design, or expression that identifies a product or service from a. The simplest answer to that question is that trademarks (and service Marks) are applied to goods and services while trade names identify businesses. Separately. Although you can apply for trademark protection for your name and logo concurrently, each is considered a separate mark. As such, each mark (i.e. And like a brand name, the point of a trademark is to identify a specific product as coming from a specific source. That's important to the holder to ensure. Trademark laws also prohibit any marks that have a likelihood of confusion with an existing one. This means that a business cannot use a symbol or brand name if.

Funds Investing In Cryptocurrency

Funds that invest in crypto use cryptocurrency, tokens, or other digital assets instead of fiat money. Because such projects have a higher ROI, you usually. There are currently more than cryptocurrency/blockchain investment funds. The majority are set up as venture capital funds, while a large number are hedge. After a major regulatory win, Bitcoin and other digital currencies are booming. These bitcoin and crypto ETFs will give you exposure to the space. Cryptocurrency investment funds allow you access to cryptocurrencies without directly purchasing, owning and trading the coins yourself. Cryptocurrency ETF. A. Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or. You should know that those who are offering crypto asset investments or services may not be in compliance with applicable law, including federal securities. Cryptocurrency exchange-traded funds (ETFs) track the price performance of cryptocurrencies by investing in a portfolio linked to their instruments. Bitwise 10 Crypto Index Fund (OTC:BITW), $ million, A means of easily investing in the top 10 largest cryptocurrencies. ; Siren Nasdaq NexGen Economy ETF . Investments in cryptocurrencies are relatively new, highly speculative, and may be subject to extreme price volatility, illiquidity, and increased risk of loss. Funds that invest in crypto use cryptocurrency, tokens, or other digital assets instead of fiat money. Because such projects have a higher ROI, you usually. There are currently more than cryptocurrency/blockchain investment funds. The majority are set up as venture capital funds, while a large number are hedge. After a major regulatory win, Bitcoin and other digital currencies are booming. These bitcoin and crypto ETFs will give you exposure to the space. Cryptocurrency investment funds allow you access to cryptocurrencies without directly purchasing, owning and trading the coins yourself. Cryptocurrency ETF. A. Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or. You should know that those who are offering crypto asset investments or services may not be in compliance with applicable law, including federal securities. Cryptocurrency exchange-traded funds (ETFs) track the price performance of cryptocurrencies by investing in a portfolio linked to their instruments. Bitwise 10 Crypto Index Fund (OTC:BITW), $ million, A means of easily investing in the top 10 largest cryptocurrencies. ; Siren Nasdaq NexGen Economy ETF . Investments in cryptocurrencies are relatively new, highly speculative, and may be subject to extreme price volatility, illiquidity, and increased risk of loss.

As bitcoin has grown in popularity, so have the investment options. One of the ways investors can invest directly in bitcoin is through crypto exchanges. For. Crypto is a high-risk investment. The value of crypto is very volatile, often fluctuating by huge amounts within a short period. Discover the new ideas and new concepts of crypto · Read expert reviews on new crypto coins and trading tools · Understand how you can save and invest with. What does the growing adoption of cryptocurrency mean for philanthropy? Charitable investors could use digital assets to fund philanthropy for the future. Cryptocurrency Exchange Traded funds (ETFs), or Crypto ETFs, can be a convenient way to invest in Cryptocurrency through your regular brokerage account. We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists. Cryptocurrency. Select a topic. All. A digital asset investment ecosystem for financial advisors and investors, offering transparent products and cryptocurrency education. Covers crypto fund research on actively managed crypto funds, crypto ETFs, crypto hedge funds, crypto VC funds, crypto mutual funds, and crypto index funds. By far the most popular way to trade cryptocurrencies is via a cryptocurrency exchange. Cryptocurrency exchanges are websites where individuals can buy, sell. Pantera launched the first cryptocurrency fund in the U.S. when bitcoin was at $65 /BTC in The firm subsequently launched the first blockchain-focused. In this guide, we'll go over how cryptocurrency mutual funds work and where you can invest in them. Quantitative Crypto Fund · Long Only Crypto Fund · Long / Short Crypto Fund · Venture Capital Crypto Fund · Decentralised Finance - Staking Fund · Security Token. For many buyers, the main appeal of crypto is as a form of investment in an innovative digital asset. While some buy into crypto for short-term speculation, for. This applies to Bitcoin, for example. Many investors have started to use cryptocurrencies as a digital asset rather than a payment method. Investors can. You can't currently trade cryptocurrencies with us, but we offer other ways to gain exposure to the crypto market. You can invest in: Funds that own crypto. The SLP/SCSp to setup a Crypto Fund as an Alternative Investment Fund · A security, (bonds, shares, funds, warrant, options, etc) · A currency, (or a. Cryptocurrency index funds work by aiming to provide participants a simple way to diversify their crypto portfolio. By participating in a group of crypto assets. These funds invest in cryptocurrency futures and do not invest directly in cryptocurrency. There is no guarantee the funds will closely track bitcoin or. Cryptocurrency, or crypto, is virtual or digital assets purchased with real money ($, £) traded on blockchain technology. It does not have all the values of. Investment Focus ; ConsenSys. 1. aPriori. $M · ; Vitalik Buterin. 1. MegaETH. $M · ; BlackRock. 1. Securitize. $M · 30 Apr

1 2 3 4 5 6 7